How does Square POS work?

Two women using Square's

point of service solutions.

Square's

S-1

Mobile payment company Square filed to go public on Wednesday

afternoon.

Now it's generating more than $850 million

annually.

How?

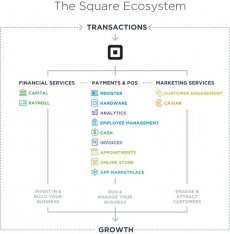

Mostly, Square allows merchants to accept mobile credit card

payments via a plastic dongle that can be inserted into the port

of a phone. Square, like a credit card company, takes a cut

of the transaction (2.75% per swipe or 3.75% plus 15

cents for manually typed transactions). It also has other

products, software, and point of sale services that make it like

the cash register of the future.

Square

But dealing with credit card companies and tiny transaction fees

isn't easy. So here's how payments are processed by Square,

according to a diagram in its S-1 filing:

Two women using Square's

point of service solutions.

Square's

S-1

Mobile payment company Square filed to go public on Wednesday

afternoon.

Now it's generating more than $850 million

annually.

How?

Mostly, Square allows merchants to accept mobile credit card

payments via a plastic dongle that can be inserted into the port

of a phone. Square, like a credit card company, takes a cut

of the transaction (2.75% per swipe or 3.75% plus 15

cents for manually typed transactions). It also has other

products, software, and point of sale services that make it like

the cash register of the future.

Square

But dealing with credit card companies and tiny transaction fees

isn't easy. So here's how payments are processed by Square,

according to a diagram in its S-1 filing:

square

Here are the four steps, from the S-1:

square

Here are the four steps, from the S-1:

- Once the Buyer is ready to make a purchase, the Seller inputs the transaction into the Square point-of-sale (POS) and presents the Buyer with the amount owed.

- The Buyer pays for the transaction by swiping or dipping their payment card, or by tapping their NFC-enabled mobile device on the Square Reader or Square Stand, which captures the Buyer’s account information.

- The Square POS sends the payment transaction information to Square, which acts as the Payment Service Provider (PSP).

- Square passes the payment transaction information to the Acquiring Processor via an internet connection. Square pays a small fixed fee per transaction to the Acquiring Process.